What is the Purpose of Estate Planning?

What is the Purpose of Estate Planning?

Estate planning involves putting your legal, financial and medical affairs in order. It may involve such important decisions as who will be taking care of you during your lifetime and what happens upon your death.

Who Should I Designate to Take Care of Me?

This is an individual choice that you should not make lightly. Who you pick to handle your assets, as well as how those assets will be managed if you become incapacitated are vital to your future. It is critical for your overall well-being that the "manager of your assets" is trustworthy and capable of undertaking the tasks that they will be required to do.

What Kind of Estate Planning do I Need?

Each person has specific needs that they may need addressed. Contrary to what most people believe, the extent of your assets are not necessarily the defining reason for doing estate planning. Speaking with an experienced elder law attorney will enable you to make the right choices for your situation.

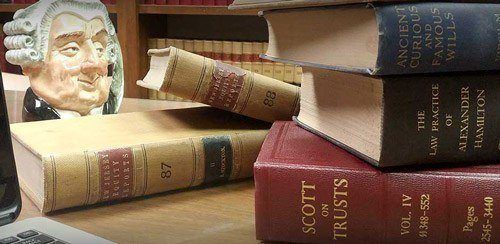

Estate planning devices may include wills, revocable or irrevocable trusts, powers of attorney, living wills, gifting, creation of family limited partnerships, or just the simple creation of joint tenancies in bank accounts, stock accounts or real property. Other more involved aspects of estate planning may deal with asset preservation for Medicaid purposes or tax planning for persons with substantial wealth.

Why is Estate Planning Necessary?

Whatever the need, every person should make the time to put his or her affairs in order. The failure to address these concerns in a timely and expeditious manner can result in a myriad of legal complications including court intervention.

What Types of Documents Should I Have?

At a minimum, every person should have a Will, a Power of Attorney and an Advanced Directive (Living Will). Together, these three documents are usually sufficient to address most people's needs. However, under certain circumstances, additional documents may be needed.